Mortgage Process in Raleigh: The mortgage process in Raleigh isn’t just about getting approved — it’s about making sure your loan is built to close in real-world conditions. In Raleigh, Wake County, and the Triangle of North Carolina, buyers who succeed understand that execution, documentation, and local expertise matter just as much as interest rate. This guide from Martini Mortgage Group explains how the mortgage process really works, where deals fall apart, and how to prepare with clarity and confidence before going under contract.

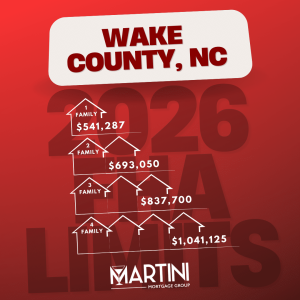

Wake County FHA Loan Limits 2026

The Wake County FHA loan limits 2026 have increased, reflecting rising home prices across the Triangle. For buyers in Raleigh, Cary, Apex, Garner, Wake Forest, and surrounding communities, these limits play a meaningful role in determining buying power — but they should never be used as a stand-alone decision tool.

Understanding how Wake County FHA loan limits work, what they mean for your city, and how to use them strategically is far more important than simply knowing the maximum.

What Are the FHA Loan Limits for Wake County in 2026?

FHA loan limits are set at the county level by the U.S. Department of Housing and Urban Development (HUD). Because Raleigh and many Triangle cities fall within Wake County, the same limits apply countywide.

2026 FHA Loan Limits for Wake County

- 1-unit (single-family): $541,287

- 2-unit (duplex): $693,050

- 3-unit (triplex): $837,700

- 4-unit (fourplex): $1,041,125

These limits apply to owner-occupied primary residences located anywhere in Wake County.

📌 Important: Cities within Wake County do not have separate FHA loan limits. Raleigh, Cary, Apex, Garner, Morrisville, Fuquay-Varina, Wake Forest, and Knightdale all follow the same limits.

Why FHA Loan Limits Increased for Wake County in 2026

FHA loan limits rise when home prices increase, and Wake County continues to experience strong market fundamentals, including:

- Sustained population growth

- Job expansion across tech, healthcare, education, and life sciences

- Ongoing housing supply constraints

- Strong demand from both local and relocating buyers

HUD adjusts FHA loan limits annually based on changes in the Federal Housing Finance Agency (FHFA) House Price Index, meaning the 2026 increase reflects what buyers are already seeing across Wake County neighborhoods.

How Wake County FHA Loan Limits Affect Buyers Across the Triangle

Higher FHA loan limits don’t just affect how much you can borrow — they influence how deals are structured.

1. More FHA Viability in Higher-Priced Areas

Buyers in markets like Cary, Apex, and parts of Raleigh may now be able to:

- Stay within the FHA instead of moving to conventional

- Use lower down payment options

- Preserve liquidity for reserves or post-purchase expenses

2. Expanded Multi-Unit Opportunities

FHA remains one of the most powerful tools for buyers considering:

- Duplex, triplex, or fourplex purchases

- Owner-occupied “house hacking”

- Long-term wealth-building strategies

3. Strategy Matters More Than Maximum Approval

Just because you qualify up to the Wake County FHA loan limit doesn’t mean you should use it.

Limits define what’s allowed — strategy defines what’s smart.

Wake County FHA Loan Limits vs. Local Home Prices

Across Wake County, affordability varies significantly by city and neighborhood.

What truly determines affordability isn’t just the purchase price, but:

- Interest rate structure

- Mortgage insurance strategy

- Seller concessions

- Property taxes and insurance

- Long-term equity trajectory

Two buyers purchasing homes at the same price — even under the FHA limit — can experience very different outcomes over the next 5–10 years, depending on how the loan is structured.

Common Misconceptions About FHA Loan Limits in Wake County

❌ “Higher FHA limits mean FHA is riskier”

FHA underwriting standards remain strict. Higher limits reflect market prices, not looser guidelines.

❌ “FHA is only for first-time buyers”

Repeat buyers and relocating homeowners throughout Wake County regularly use FHA loans.

❌ “The loan limit determines approval”

Approval depends on:

- Income stability

- Credit profile

- Debt structure

- Asset positioning

The FHA loan limit is only one piece of the equation.

Choosing the Right FHA Lender in Wake County Matters

Not all FHA lenders operate the same way — even though they follow the same HUD guidelines.

Key differences often include:

- Underwriting overlays beyond FHA minimums

- Down payment sourcing flexibility

- How mortgage insurance is structured and explained

- Local appraisal and market expertise

- Experience with multi-unit and specialty FHA scenarios

A strong FHA lender in Wake County doesn’t just provide a rate quote. They help ensure the loan supports both your purchase today and your financial flexibility tomorrow.

Our Fiduciary FHA Approach

At Martini Mortgage Group, FHA is never treated as a default solution.

We take a fiduciary-style, clarity-based approach, helping buyers understand when FHA makes sense, when it doesn’t, and how it compares to other loan options.

That includes evaluating:

- FHA vs. conventional break-even analysis

- Short-term affordability vs. long-term equity

- Refinance and exit strategies

- Cash preservation vs. leverage

- Market-specific pricing trends across Wake County

When used correctly, FHA can be a powerful bridge to homeownership and long-term stability — not just a way to maximize approval.

👉 For a Raleigh-specific breakdown, see our full guide on Raleigh FHA Loan Limits 2026.

TL;DR: Wake County FHA Loan Limits 2026

- Wake County FHA loan limits apply to all cities in the county

- The 2026 single-family FHA limit is $541,287

- Higher limits create more flexibility — but strategy matters more than the maximum

- FHA remains a strong option for first-time buyers, repeat buyers, and multi-unit purchases

- Choosing the right lender can materially affect long-term outcomes

Logan Martini