Mortgage Process in Raleigh: The mortgage process in Raleigh isn’t just about getting approved — it’s about making sure your loan is built to close in real-world conditions. In Raleigh, Wake County, and the Triangle of North Carolina, buyers who succeed understand that execution, documentation, and local expertise matter just as much as interest rate. This guide from Martini Mortgage Group explains how the mortgage process really works, where deals fall apart, and how to prepare with clarity and confidence before going under contract.

Buying a Home in Raleigh Still Pays Off in the Long Run

Buying a home in Raleigh can feel overwhelming—especially when rent seems simpler, cheaper, and commitment-free. No repairs. No property taxes. No watching mortgage rates bounce around like a heart-rate monitor. You just pay the bill and move on with your life.

But here’s the part almost nobody tells you: renting keeps you comfortable today, but it won’t build your tomorrow.

Meanwhile, Raleigh homeowners grow their net worth just by living in a home they own.

As a fiduciary-style mortgage strategist at Martini Mortgage Group, our job isn’t to sell you a mortgage. It’s to give you clarity—so you can make a confident decision that supports your long-term financial life.

Let’s break down the real math behind renting vs. buying in Raleigh, and why ownership continues to win over time.

Table of Contents: Buying a Home in Raleigh

Table of Contents

Raleigh Renting vs. Owning: The Long-Term Wealth Gap Is Real

Renting can absolutely feel cheaper in the moment. But long-term? The financial picture shifts dramatically.

When you rent: Your payment disappears. No equity. No appreciation. No return.

When you own: Part of your monthly payment comes back to you through two powerful forces:

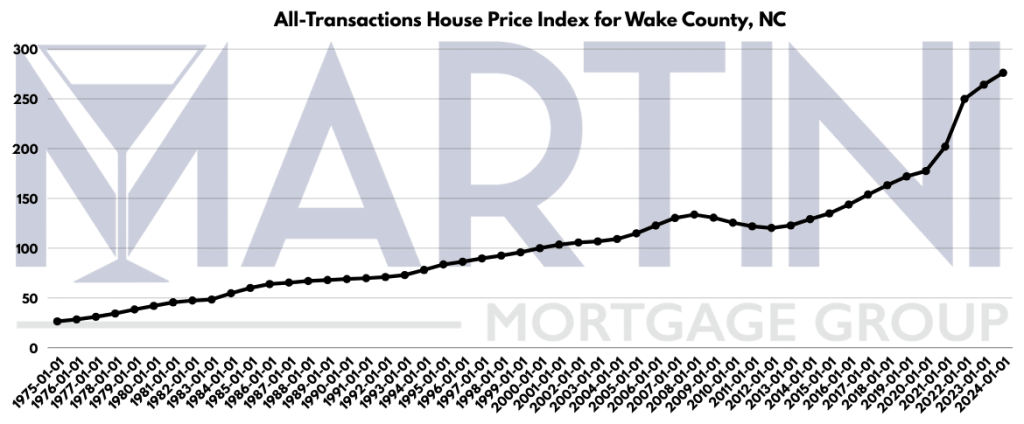

- Home price appreciation (Raleigh has averaged positive annual growth for decades, according to FHFA data).

- Principal paydown (your loan balance decreases every month).

According to a recent analysis, comparing multiple housing cycles (including 2006, 2015, 2019, and 2022), two things were true in every scenario:

- Renters lost net worth over time

- Homeowners gained it—substantially

And this held true even after accounting for property taxes, homeowners’ insurance, repairs, and maintenance.

In Raleigh and Wake County—where population growth and demand remain strong—the wealth gap between renting and owning widens faster because home appreciation has consistently outpaced national averages.

Time in a home builds wealth. Time renting doesn’t.

Why Raleigh Homes Tend to Appreciate Over Time

Raleigh isn’t just a city. It’s an economic engine.

Here’s what’s fueling sustained appreciation:

1. Strong job and population growth

Wake County is growing by 66 people a day, according to WRAL. Tech, healthcare, and biotech continue to expand, creating upward pressure on demand.

2. Limited inventory

New construction has never fully caught up with population growth, especially in Cary, Apex, and Inside-the-Beltline Raleigh. Scarcity supports long-term price stability.

3. Highly ranked quality of life

Raleigh consistently ranks among the best places to live in the U.S. (per U.S. News & World Report), helping maintain buyer demand even in shifting markets.

The combination of strong demand + constrained supply + stable economic fundamentals makes the Raleigh market historically resilient—and historically rewarding for long-term homeowners.

Affordability in Raleigh Is Improving (Even If It Doesn’t Feel Like It)

Let’s acknowledge reality: Buying a home has felt harder since rates jumped in 2022.

A typical monthly mortgage payments nationwide have become slightly more affordable compared to last year due to:

- Lower mortgage rates

- Rising wages

- Slower home price growth

Locally, the same trend is unfolding:

✔️ Mortgage rates have eased in 2025

✔️ Raleigh price growth has decelerated from pandemic highs

✔️ Wage growth continues across tech, healthcare, and education sectors

✔️ More listings are hitting the market compared to 2023–2024

Is it suddenly easy? No.

Is it easier than it was a few months (or a year) ago? Yes.

And when affordability improves while long-term wealth benefits remain strong, buying becomes increasingly compelling for many Raleigh families.

The True Cost of Waiting in Raleigh

Many aspiring homeowners feel they should “wait for the market to get better.”

Totally understandable. But here’s the data-backed challenge:

Waiting often costs more than buying.

Why?

1. Raleigh home prices rarely fall long-term

FRED’s All-Transactions House Price Index for Wake County shows that even during national slowdowns, local home values tend to pause briefly before continuing their long-term upward trend.

2. Rent increases compound faster than people expect

Raleigh rents have increased ~25%+ over the past five years. That’s real money lost.

3. Delaying ownership delays equity growth

Every year you wait is one year you don’t build equity through:

- Appreciation

- Principal reduction

The data proves that even buyers who purchased at peak markets (like 2006 and 2022) still outperformed renters over time.

This is the power of duration. The longer you own, the wider the wealth gap grows.

How to Buy Smart in Raleigh — Even If the Market Feels Tricky

Buying in Raleigh doesn’t require perfect timing or perfect financial conditions. It requires a plan.

At Martini Mortgage Group, our fiduciary-style approach starts with clarity:

✔️ What can you comfortably afford?

(Not the max on paper — the max for your life.)

✔️ What strategies increase approval strength?

Our Same-As-Cash Mortgage Approval gives you competitive leverage in multiple-offer situations.

✔️ What programs match your long-term goals?

Conventional, FHA, VA, USDA, down payment assistance, or even strategic recasting — the best option is the one that supports your future, not just your closing day.

If you want a deeper dive into programs and strategy, explore the

North Carolina Mortgage Guide or Dreams to Doorsteps: A Raleigh Homebuyer Guide, a Raleigh homebuyer guide, or tap into local insights through the Martini Mortgage Podcast.

You don’t need perfection to move forward. You need good information, the right game plan, and a team that acts in your best financial interest.

TL;DR: Why Buying a Home in Raleigh Still Builds Long-Term Wealth

Buying a home in Raleigh remains one of the strongest long-term wealth strategies available. While renting may feel simpler or cheaper today, it builds no equity, no appreciation, and no financial return. Raleigh homeowners, on the other hand, benefit from steady home price growth, monthly principal paydown, and a resilient local market supported by strong job growth, limited inventory, and high quality of life. With affordability improving and long-term appreciation trends intact, waiting often costs more than buying—especially in Wake County, where home values historically pause but rarely fall. Time in the market matters more than timing the market, and the sooner you start owning, the sooner you start building wealth.

FAQ: Homeownership, Affordability, and Buying a Home in Raleigh

Is buying a home in Raleigh still worth it in today’s market?

Yes. Raleigh continues to outperform national housing trends due to strong job growth, steady migration, and limited inventory. FHFA and FRED home price data show that Wake County home values rarely decline over the long term—they may pause, but they historically resume climbing. This creates reliable long-term wealth for homeowners.

What if renting is cheaper for me right now?

Rent may be cheaper today, but it builds zero long-term financial benefit. Every rent payment disappears. Homeowners gain equity through appreciation and principal reduction—two wealth engines renters never access. Even during soft markets, homeowners consistently outperform renters over time.

Should I wait for mortgage rates to drop before buying?

Waiting for “perfect” rates can backfire. Raleigh home prices tend to rise faster than rates fall. The longer you wait, the more you may pay later—both in higher purchase prices and lost equity growth. Your best strategy is to buy when your budget and lifestyle align, then refinance if rates improve.

Do Raleigh home prices ever fall?

Significant long-term declines are rare. FRED’s FHFA All-Transactions House Price Index for Wake County shows that during national slowdowns, prices typically stall briefly, then continue upward. This resilience is driven by strong demand, population growth, job stability, and limited supply across Cary, Apex, and Raleigh.

Kevin Martini