Right now, there is noise about real estate and mortgage rates and sadly the real truth and the real opportunity is being missed. Fluctuating mortgage rates, home price deceleration and looming recession are facts but, is a recession bad for real estate values? Is there a pure need for real estate? Are home loan rates just going to get more expensive or are they going to retreat?

In this special episode of the Martini Mortgage Podcast, Certified Mortgage Advisor and Raleigh mortgage broker Kevin Martini takes a glimpse of the headlines and goes deep into the data about where home values are headed and where mortgager rates are headed.

Audio Edition of the Martini Mortgage Podcast with Kevin Martini

Video Edition of the Martini Mortgage Podcast with Kevin Martini

Consumer Price Index (a.k.a. CPI)

Recession and Home Values

The housing market caused the great recession, the recession did not cause the housing crisis. Again, recession doe into mean housing crisis.

Housing Formations

New Home Supply

Today there are about 1.7 housing starts but a housing start is not a new homes built they are new home started. So that is not a metric to look at, completed homes and that is at 1.3 million but remember annually there are 100,000 homes that are destroyed. So now there are 1.2 million homes and there is a need for 1.4 million homes so there is a deficit of 200,000 homes.

It kinda feels like we are walking the tracks in a very dark tunnel right now however, there is a glimmer of light at the end of the tunnel. What is that light coming from? Is that light from a train that is coming straight towards us or is that light a from the sunlight where we can be sitting siping a drink with an umbrella? I know that light is not coming from the bow of the train and I know that light is paradise.

To me, it appears that every news segment leads with the death of real estate or every headline online is talking how high mortgage rates are. Everyone sees these headlines but only 30% actually read the article. Crazy stat isn’t it? 70% of people make a decision on what to do based on a headline only. In this special episode of the Martini Mortgage Podcast let me take you beyond the headlines and deep into the story that now one is talking about.

Welcome to special episode 147 of the Martini Mortgage Podcast, my name is Kevin Martini and I am a Certified Mortgage Advisor with the Martini Mortgage Group which is located in Raleigh, North Carolina however myself along with my very talented crew of mortgage professionals help families in all 100 counties of North Carolina and pretty much in ever state in the U.S. too! I am calling this special episode of the Martini Mortgage Podcast; Now is the real estate opportunity!

Deceleration of home values, inventory increasing, inflation at a four decade high, six-dollar gasoline, mortgage rates fluctuating upwards, the Fed and the evil ‘r’ word, recession! So much to unpack where do I start.

As a primer, one needs to know that mortgage rates live in the Bond market. The nemesis to a Bond is inflation because inflation erodes the return of a Bond. When Bond prices fall, to attract more buyers, a higher yield is offered. When a higher yield is offered it means there are higher home loan rates available in the market.

Higher mortgage rates did not cause inflation, inflation caused higher mortgage rates. For the people in the back, let me say it another way…inflation drives mortgage rates so when inflation rises you will see that mortgage rates rise. This is very important to understand because a driving force to Bond prices is inflation.

It is my opinion, inflation is going to get worse before it will get better so that means mortgage rates are going to get more expensive and you know what else is going to get more expensive, homes…yes, granted homes will not appreciate at the levels they have over that last several years but they are still going to appreciate. With that said, I am reminded of what my real estate partner always shares with her clients — she says: “marry the house but date the rate”. What an amazing analogy and one that is not just timeless but very timely.

Let me talk about the Consumer Price Index, which is also referred to as the CPI for a moment. At the time of this recording, which is at the last days of June 2022, the CPI had a reading of 8.6%. It is critical one understands the CPI is a measurement from the same month last year. This is very important to understand, CPI is a measurement from the same month a year ago.

Here is the the Kevin Martini forecast on inflation and mortgage rates.

First, mortgage rates will be basically at the current level until mid July 2022 and many news outlets will be claiming that inflation has peaked in mid July. When I say mid July, the pivot to even higher mortgage rates will start on July 13th.

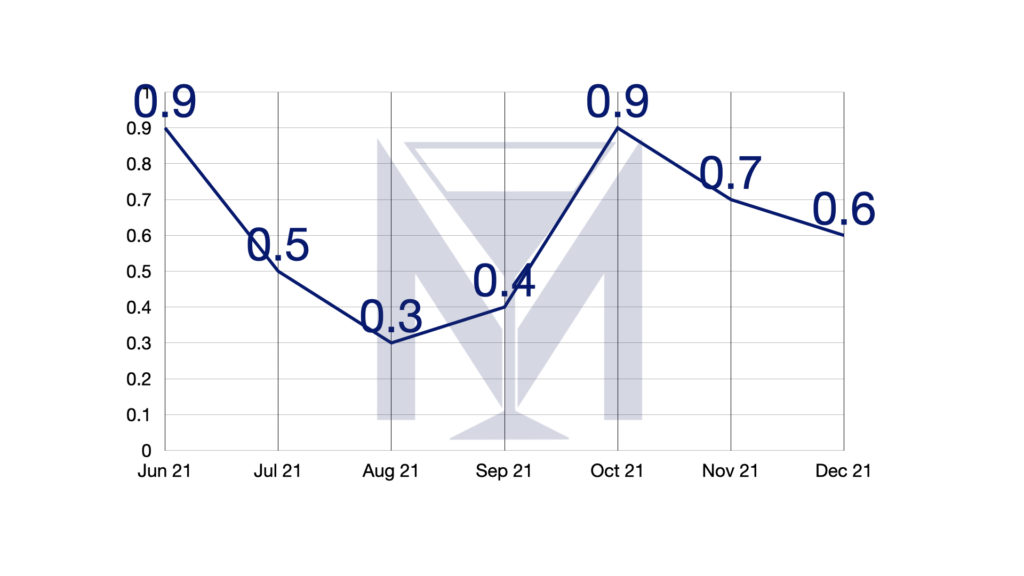

Why do they believe people say inflation has peaked in July? Well, simply put, we know that in June 2021, the inflation reading was 0.9% and the June 2022 number will be compared to June 2021.

Here is the thing that one needs to keep top of mind. In July 2021 the CPI was at 0.5, in August 2021 the CPI was at 0.3% and in September 2021 the CPI was at 0.4%. Punchline, the CPI was low as compared to today. It is my opinion, with six dollar gasoline and with all the containers just waiting to ship from Shanghai, there will not be a rise and repeat of those percentages and… inflation will rise significantly and so will mortgage rates. Then let us pepper in the the July 27th and September 21st Fed meeting.

It would be nice if we heard the word ‘pause’ from the Fed at their September 21st meeting however I have found the Fed is always late to the party and they stay too long at the party. With that said, I see the calgary coming to help mortgage rates towards the end of 2022 but more likely in the beginning of 2023.

The rate one has today will not likely be the rate they will have in 2023 or 2024 because, based on the data, there will be rate relief and an opportunity to marry a lower rate than one has secured in 2022.

So why not just wait? Why should one marry the house and date the rate today, why not just date the house, in other words, why doesn’t one just rent and wait. I can understand why one would ask this question. The answer to the question is simple, because home values will continue to keep growing and growing and growing.

With an open heart, right now we are living in what people will call in the future the good old days of real estate. Yes, right now is still an epic time to buy a house to call home and right now is an epic time to buy a house to rent even with the fact that I believe a recession is eminent.

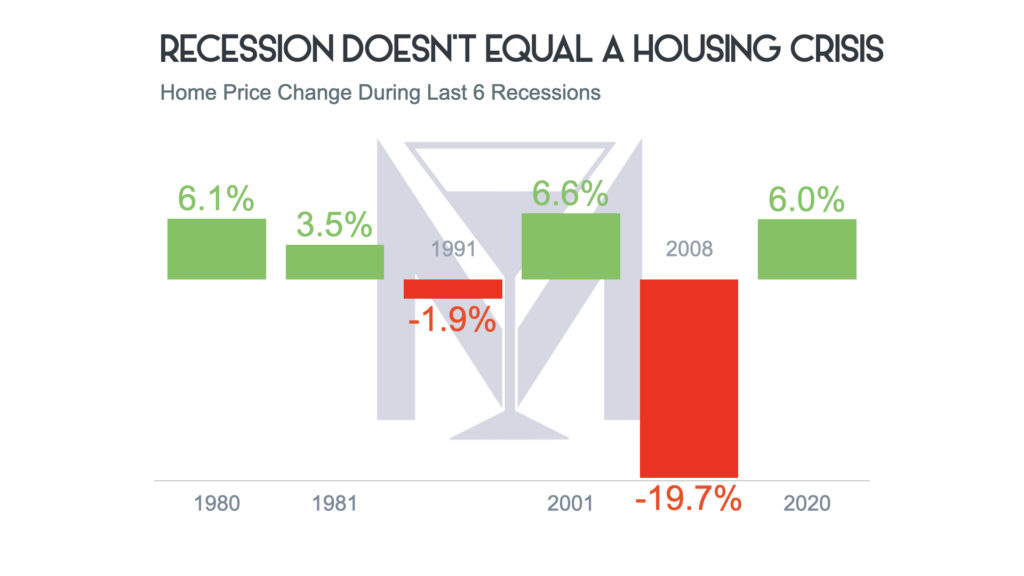

Yes, a recession is ahead and recessions have proven to be positive for home values. In the U.S. there have been 6 recession since 1980. 1 of the 6 was the great recession where home values went down 19.7 percent. One need to know this…the demand that was before the great recession was based on speculation and speculation made price skyrocket. The housing market caused the great recession, the recession did not cause the housing crisis. Again, recession doe into mean housing crisis.

If you take the great recession out of the equation 4 out of 5 times there was a recession in the U.S., home values went up an average of 5.5%. The one out of five time it went down, values only went down 1.9%.

There was a real estate bubble that created the great recession. The real estate bubble was created in part by speculation. Today, real estate is needed and there is an under supply.

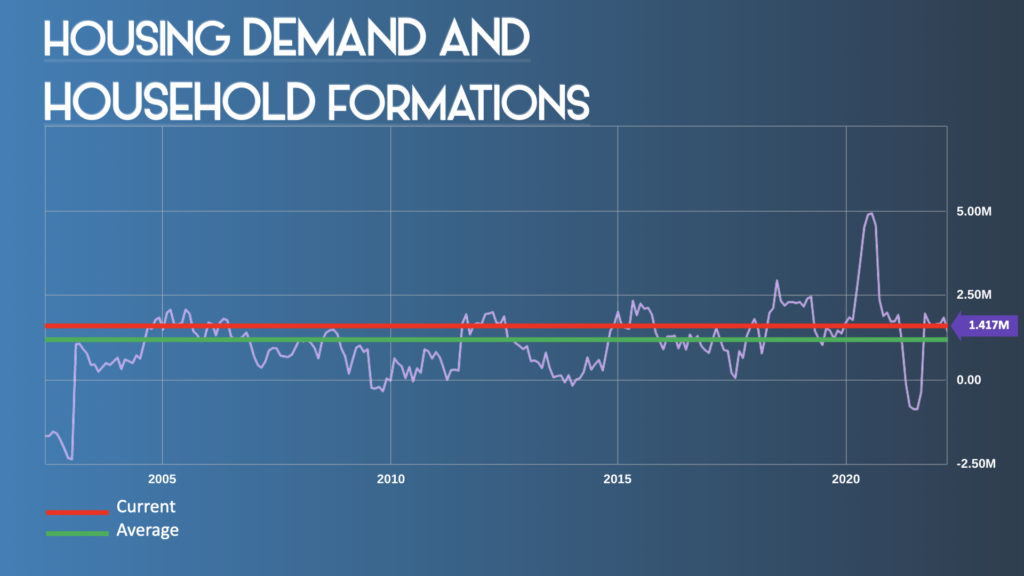

Let me go into a little more detail on the need for housing or housing demand. Let me start with household formations. First, what is a household formation. Simple put, someone leaves mom and dad and occupies a new place. So, when one occupies a new residence without vacating your residence is a household formation. Here is another example. A couple is living together but they break up and one moves out, you now need to 2 place not one, this is another example of a household formation. In the U.S. there are 1.4 million new household formations. Oh by the way, household formations are about 20% above the average right now so simply put, this is your real demand based on need. 1.4 million people need a roof.

Today there are about 1.7 housing starts but a housing start is not a new homes built they are new home started. So that is not a metric to look at, completed homes and that is at 1.3 million but remember annually there are 100,000 homes that are destroyed. So now there are 1.2 million homes and there is a need for 1.4 million homes so there is a deficit of 200,000 homes.

Is home ownership right for you and your family, I do not know but what I do know is that you owe it to explore your options that are available. I truly believe to create generational wealth one needs to own real estate. I also know that the process of homeownership always starts with the home loan first and then go find your home. It is never find your home first and then find the right loan.

My name is Kevin Martini and I am a Certified Mortgage Advisor and I am here to help. I know in this special episode of the Martini Mortgage Podcast there was a lot of data shared, I am here to answer your questions about it. If homeownership is right for you, right now is an unprecedented opportunity.

Thank you for tuning in and please share this episode with someone you care about.

Now it is time for the disclaimer:

This material has been prepared for marketing purposes only. This is not a loan commitment or guarantee of any kind.

Loan approval and rate are dependent upon borrower credit, collateral, financial history, and program availability at time of origination.

Rates and terms are subject to change without notice.

The Martini Mortgage Group at PCL Financial is a division of Celebrity Home Loans, NMLS # 227765 with a Branch address of 507 N Blount St Raleigh, North Carolina 27604.

You can contact Certified Mortgage Advisor and Producing Branch Manager, Kevin Martini NMLS# 143962 by calling the Branch and that number is 919.238.4934. For a full list and more licensing information please visit: www.NMLSConsumerAccess.org or by visiting www.MartiniMortgageGroup.com – Equal Housing Lender